There’s plenty of blame to spread around for the underfunded public employee pension funds now at the mercy of a bankruptcy judge.

City officials didn't make the required contributions to those funds for years while fully paying other creditors. That’s problem one. They always promised to square up at some undetermined later date, although how or from what pot of money they'd repay the pension funds was never explained. In truth, city officials probably had no clue they'd get even.

Deferring pension fund contribution was the municipal equivalent of a payday loan. Montel Williams came up with the idea, for all we know. In any case, it seems unlikely Detroit could ever come to terms with their outstanding pension obligations.

Then there’s the fact that an impoverished municipality with a declining population and tax base simply wasn’t going to be able to sustain pension promises made during a more robust time. It’s nothing short of criminal that no action was taken decades ago—a statewide public employee pension system, perhaps—to ensure workers received their promised retirement without crippling Detroit with excessive legacy costs.

And finally there are the many remarkably bad investments made by pension boards on behalf of retirees. Before we go any further, let’s define our terms here. A “bad investment” isn’t one that, in an otherwise profitable diversified investment portfolio, didn’t happen to pay off. That happens. By bad investment, I mean one so reckless and irresponsible that it's the poke equivalent of going all-in before the flop while holding pocket fives.

Nothing embodies that fecklessness like the $30 million investment in the Alabama-based TradeWinds Airlines operated by an acquaintance of Kilpatrick Enterprise then-city treasurer Jeffrey Beasley. After just three weeks to conduct due diligence, both the general retirement fund and the police and fire fund each dumped $15 million into this venture in December 2007.

The airline went bust and this spring it agreed to repay Detroit’s pension funds $4.25 million sometime between now and 2017.

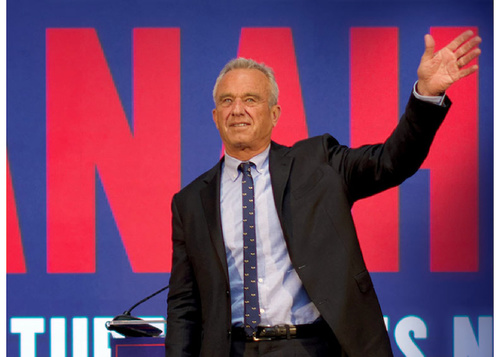

One wonders if the pension funds' trustees ever heard of Robert Crandall, the legendary former chairman of American Airlines. Crandall famously advised American employees against investing in their own company.

“I've never invested in any airline,” Crandall said in an interview. “I'm an airline manager. I don't invest in airlines. And I always said to the employees of American, 'This is not an appropriate investment. It's a great place to work and it's a great company that does important work. But airlines are not an investment.'”

You don't say.

Opportunity Cost

On paper, Detroit’s retirees lost $26 million on the deal but that only tells part of the story. There’s also the little matter of opportunity cost. The pension funds, after all, wouldn't otherwise stuff that $30 million under the mattress.

Curious about what an alternative safe investment might look like, I spoke with someone familiar with institutional investing. My source, by the way, was genuinely surprised to learn Detroit's pension funds were risking assets on speculative “one off” ventures like this. Usually pension funds stick with safe-and-sound index investments like the S&P 500 or a global index known as MSCI ACWI.

Had the pension boards followed that conservative approach with this particular $30 million, what would have happened?

There are a number of online investment calculators that help us figure that out, so we can offer a definitive answer.

In the period between December 1, 2007 and July 1, 2013, the $30 million dumped into a failed airline could have earned a 2.86% average annual return from MSCI ACWI or 1.99% from the S&P. That may not sound like much, but consider the 2008 financial meltdown is factored into that number. Another few years of more normal investment cycles and the rate of return would likely improve.

Even at 2.86%, MSCI ACWI would have already turned that $30 million into $34,542,507. The real loss from the airline investment was $26 million in actual loss plus an opportunity cost of $4,542,507 and rising. Just how much MSCI ACWI could have earned Detroit's pensioners by 2017 when that TradeWinds settlement finally comes due is still another question.

Now when emergency manager Kevyn Orr says the pension funds are facing a $3.5 billion shortfall, one might be tempted to dismiss $30 million as pocket change, but after a few $26 million loses here and $4.5 million opportunity costs there, pretty soon you’re talking about real money.

This kind of reckless investment may not be the sole, or even the primary, cause of the pension funds shortfalls, but it is low-hanging fruit. How much less painful would the bankruptcy process be for retirees and city workers if the funds had behaved in a more responsible manner, if they had done the careful hard work to ensure they weren't throwing money into toilets like TradeWinds Airlines?

I theoretically turned a $26 million loss into a $4.5 million (and climbing) profit by having a short conversation with someone familiar with institutional investing on a Saturday afternoon. No business class trip to Dubai was required.

Now, just imagine how these funds would look today if they were run by John Houseman’s guys instead of the clowns at city hall.